Click here to download a PDF of this post.

Click here to download a PDF of this post.

Just like diligent Realtors, loan officers need to take continuing education to improve their skills and learn new ways to help the agents they work with succeed in their business. If the Realtor is successful, so will their loan officer partner be. If we are NOT already working together, I am applying for that job!

As a buyer agent out there showing homes, in competitive situations with multiple offers, you have to maximize the chances of getting your buyer's offer accepted.

Imagine there are 10 offers on just one house... The buyer has a 90% chance of NOT getting it. Basically, by doing these 10 things that I'm suggesting here, you're putting the thumb on the scale, leaning the odds in your direction, and your buyer will love you for this.

At a recent seminar, one of the round-table topics that came up was how we could best help our Realtor partners to get their offer accepted when there was competition from other buyers.

So how can I help to get your buyer's offer accepted in these times of housing inventory issues when there are more buyers than sellers?

To give you some options to help make you more successful, I've taken the time to put together a free report for all agents entitled “

10 Ways To Get Your Buyer's Offer Accepted In A Seller's Market”.

The lack of inventory issue is a real problem for agents and lenders alike. I know many loan officers across the country are banging their heads against the wall, saying, "Gee, I've got all these people pre-approved and they can't find their house or they're having difficulty getting their offer accepted." It's a real problem.

Let's go over this list then. What are the top 10 ways to help get your buyer's offer accepted?

By the way, listing agents should also pay attention to these… you can see which ones would best fit with your seller's situation and suggest specific clauses in any buyer's offer that would help your seller to get their home on the market.

Offer The Seller A Rent-Back Option After Title Has Changed Hands

Many times the seller is really encouraged to get their existing house sold because maybe they're building a new house, and they know that they have three months before this house is going to be complete. Therefore, they're putting their house on the market now because they don't want to be stranded having two homes at the same time. They're putting their house up at the earliest time that they feel comfortable to do that BUT nobody wants to make themselves homeless by selling their current house and the new one not be move-in ready.

I think that's one of the reasons why we're having the shortage of inventory. We have so many sellers who don't know if they're going to be able to find that next perfect house they're going to be comfortable buying.

The fear is they don't want to sell their house without knowing there's a new home waiting for them. Explore whether your buyer can be creative and agree to make an offer to the seller. For example, say, "Okay, I'll close on the house so that you have your money in your pocket, but you can also rent it back from me for a month or 45 days or whatever, until your next house is ready for you to move into." Heck! Let them stay for free if it makes the difference!

This will decrease the pressure and fear for that seller to be able to do whatever they need to on their own timeframe. However, be sure to ask me first regarding mortgage related occupancy time requirements.

It's important for all of us… buyer's agents, listing agents and loan officers… to educate our clients, our tribe of clients who might want to be selling right now but they have that fear of being homeless or accepting an offer that isn't going to close, to some alternate options.

By the way, sometimes as their loan officer, I can restructure the seller's debt and maybe get a HELOC to pay it off so they can qualify short-term to own two homes at the same time, so that helps to get the process moving.

They could feel comfortable listing their house sooner than they would have otherwise.

Text Lender Reviews To The Listing Agent

For this to work, I need to coordinate with the buyer's agent to make sure that I have the offer presentation timing down.

I'll send a link to the many five-star reviews that I've received to give a leg up to getting your offer accepted since it's ME providing the buyer with their pre-approval.

Our goal is to make sure that seller has total confidence that they're dealing with a professional loan officer working on the buyer's behalf.

The seller doesn't want a buyer's loan approval to be coming from some fly-by-night loan officer from who knows where. However, if you can really establish Toby Lynn at The Mortgage Firm as somebody who has a good number of reviews, and those reviews are very positive, that's going to help them have more confidence in acceptance of your offer.

I have reviews from Google and other sources that I can supply. Plus, I have more on my own website.

I can send them over to both the listing agent and the actual seller as a part of the buyer agent's offer package. When the seller is looking at several different offers and only one comes with positive loan officer reviews showing that the lender can actually make the closing happen, this will really elevate your offer in the seller's eyes.

I guarantee you; none of the other offers is going to have that extra confidence building aspect to them.

Not only will your buyer appreciate it, the buyer agent's bank account will appreciate it too because you're much more likely to get the sale.

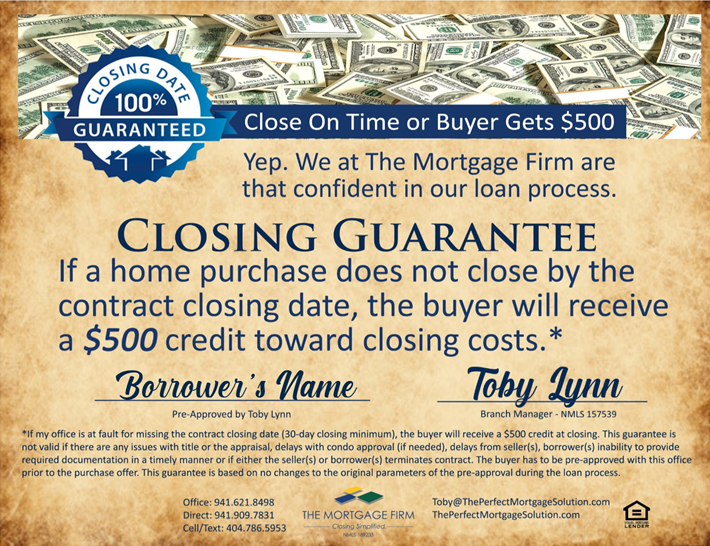

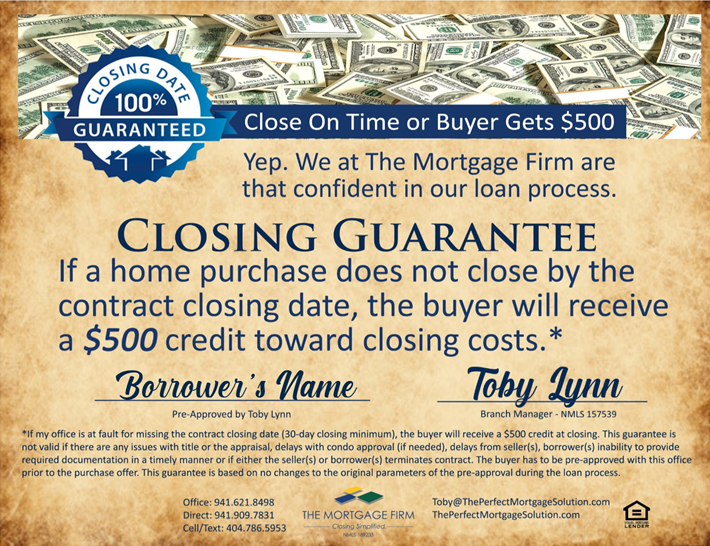

Close On Time Guaranteed

Many of the things that we're trying to do are going to be a visual offering to the seller and the listing agent that's going to help your offer to stand out from other agent's offers.

The

Close-On-Time Certificate can guarantee to the buyer that we'll close their loan on time. With a small asterisk, pointing out the buyer needs to be pre-approved prior to the offer presentation. However, if they've already given us all the documentation we need, we pretty much just need to add the property and we're good to go on.

The close on time guarantee says I'll pay $500 to the buyer as a credit at closing IF our closing doesn't happen when it's supposed it.

Showing this at offer presentation time is going to help the sellers feel comfortable and think to themselves, “I know that I'm not getting the $500 as the seller but I now have more confidence that this particular buyer's loan officer is very professional, and this gives me more confidence that my closing will happen smoothly and on time

So even though the guarantee is not actually being made directly to the seller (and can't be according to lender compliance rules), both the seller and the listing agent now know that I put my money where my mouth is, that I've got a cash guarantee to the buyer, that gives them confidence.

The sellers are thinking to themselves… "You must think you're going to close on time. Otherwise, you wouldn't have this bet going with the buyer that you can close on time."

That, in conjunction with texting them my reviews that you have ahead of time, with a certificate showing that you're going to close on time guaranteed to the buyer, both give the seller and the listing agent much more confidence in accepting our client's offer.

We Close Faster Than The Big Banks

The average mortgage close time in the United States is approximately 58 days.

Because my average is about 30 days, it shows I'm better than my competition in general, and I'm willing to offer a guarantee to back it up.

Call The Listing Agent And Do A BombBomb Video Ahead Of Or At The Same Time As The Offer Presentation Time

Imagine yourself as the seller's agent… you've put a sign in the yard and, within hours or days, you start getting multiple offers in the door. That seller's agent has to think of good reasons why he should recommend one offer over another.

Remember, all of these ideas stacked up together give you a little bit more face time with that seller and listing agent. The listing agent is not the final decision maker, but their advice is very highly regarded by the seller. Oftentimes, the seller may say, "I don't know which one is the best offer. Which one do you recommend?”

And it's not always the highest price that wins the prize!

Sometimes the lucky offer winner is going to be who will let the seller move out when they want to. In addition, sometimes it's going to be, "Hey, I got a call from Toby Lynn and, man, she sure was a nice lady and it sounded like she knew what she was talking about. The buyer's agent also told me the story about their family. I just really appreciated both of them reaching out."

If the seller and the listing agent already have a good feeling about your buyer and the buyer's lender because you're one of the few people who were proactive enough to actually reach out to them, it helps them make their job easier. I think this strategy is going to give you and your buyer a leg up.

The listing agent is doing nothing more than just looking for confidence that you're actually going to close it on time. They'll take that over an extra $5,000 of selling price every day of the week and make the recommendation to the seller to accept the offer.

In this scenario, the plan would be for me to do a short intro video introducing the buyer's ability to have loan approval and myself to the seller and the listing agent.

I would get my client's permission to share some personal information. I'll talk to them and say, "Hey, I get it, it's not cool for me to share any personally identifying information about you”. However, some sharing of the buyer's situation can give a lot of confidence to the seller.

Perhaps I'd suggest sharing their 806 credit score and the fact that they've been on the same job for seven years giving the impression that they're a solid borrower.

This way their listing agent could forward that video to the seller.

Buyer Love Letter

Many times, by having the buyer write out their personal story in a concise manner will help persuade the seller to look at your buyer's offer more favorably.

Details about the buyer's family, how their children love the area or the local school, and how the buyer feels about the seller's home, in particular, will help lean the seller towards your purchaser. Perhaps how this particular house has easy handicap person access for the buyer's elderly parent will resonate.

It's all about making it personal between the buyer and seller. The letter could go something like this (true statements always of course)…

"It looks like you had a fine home and you raised your kids there. We would love to buy your house, raise our kids and continue with that tradition. We'd love to invite you and Mrs. Seller over one day this summer for that barbecue out by the pool to continue the tradition."

The letter is important because we all know deep down that we make decisions with our heart, not our head. That's just the way it is. In addition, if you could prepare a little buyer love letter and target some heartstrings a little bit, while keeping to the truth of course, this is an absolute killer idea.

Pre-Approval Checklist To Share

It's critical to help the seller understand the thoroughness of my pre-approval process and not be concerned that the buyer won't ultimately qualify for the mortgage. My pre-approvals are adjustable and electronic. You can make the change and submit without waiting for me.

In addition, to help the seller feel comfortable with your buyer's offer, we can put together a checklist that has a thorough list of ‘hot-button' items the seller is interested in knowing… for example we've checked their income, we've checked their assets, we've already verified assets needed to close.

We've already gotten all of these things done. We've also run the AUS (Automatic Underwriting System) to confirm a loan approval.

If I've put my check mark on each of those, it will be a big confidence builder for the seller their home will close.

All of this confirms that your buyer's offer is going to close on time, and that you have a close-on-time guarantee. I've provided you with a solid pre-approval and it conveys that competence over to both the seller and the listing agent.

Appraisal Waiver

In certain situations, I might get a property appraisal waiver for the loan. We may not even need an appraisal, if the buyer agrees.

If we can remove every doubt that the seller has of your buyer being able to close, and help solidify that our buyer is the best risk for that seller, we win.

Ask The Seller's Agent What The Seller Really Wants

I think sometimes we totally miss that the seller is the one who has to be happy with the offer. Remember, it's not always the highest number that takes the sale. Sometimes what they really want is to make sure that they're selling to a family who is going to fit in with their neighbors, take care of their home, etc.

Why are they selling now? What's the ideal closing date for the seller? Have they purchased something else already? Are there several seller family members participating in the offer negotiation? What sort of flexibility might there be from the list price or, in the case if the home is listed under market value, what price point are they aiming for? What's most important to the seller at the end of the day?

To summarize… know your seller's situation as much as possible BEFORE presenting your offer. If you do, you'll be better able to customize it and have a better chance of acceptance.

Remember, your offer is just ones and zeros on a page. There may be no differentiating factor between your offer and your competition if you don't actually try to find out what exactly is important to this seller.

Maybe there's a story that you're going to uncover, that you're going to be able to connect with, that gives you a leg up at the negotiation table.

When you call the listing agent to talk about my closing on time guarantee, Toby's lender reviews and describing my pre-approved checklist, it's time to ask, "But as I say all these things, let me ask you this, what is it that the seller really wants?"

Just ask the question and listen to what they've got to say.

They might just say, "Hey, just the best price," or they might say, "Well, you know what? It's funny you should ask. What they're really looking for here is..." blank. In addition, if there's any way that you and your client can fill that, whatever that need is... Man, that's a killer idea.

I'm Here To Help You Succeed

The first step in my helping you is to connect me with your buyer as soon as possible in the process.

I'll do my analysis of their financial situation, help them understand how the borrowing process goes and get their pre-approval underway.

Text or call me at 941-909-7831 anytime.

My office is in downtown Punta Gorda in the ‘Green House' at 308 Sullivan Street.

Toby

Click here to download a PDF of this post.

Click here to download a PDF of this post.